Video Filters

Mastering the Mental Game of Investing

A video series to help you develop the mindset of a successful investor.

Watch the Series60 Videos

PM Chris Davis with David Rubenstein of Carlyle Group

Why all true investing is value investing, the importance of patience, resisting momentum-driven markets, maintaining discipline through volatility.

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

Stewardship, Patience and Going Against the Crowd (3:59)

Chris Davis and Bill Miller reflect on 40 years of friendship and how temperament has impacted their respective investment styles

Navigating Today’s Volatility (3:52)

Why experience teaches that “You make most of your money in a bear market, you just don’t realize it at the time”

Tariffs, Geopolitics and the Fallacy of Forecasts (3:50)

Markets overreact in the face of uncertainty. Our economy, businesses and markets are dynamic and will adapt – a huge strength

Amazon, GE and What to Look for in a Business (3:53)

How a company management can create or destroy business value over time

Free Cash Flow Yield as a Measure of Value (2:13)

The insight that this obscure statistic can reveal about the valuation of a business

The Invaluable Role of the Advisor (1:55)

How an advisor can help guide clients’ perspective in good markets and bad, fostering the successful compounding of wealth

What Gets You Excited About the Next Decade? (2:49)

Beyond the growth expected via breakthrough technologies, the low prices produced by uncertainty should excite every rational investor

AI: Separating Hype from Opportunity (4:17)

Why the leaders of any tech revolution do not always end up the winners – No one can dictate outcomes and adaptability will be key

Why Cash May Not be King (1:45)

Being on the sidelines may feel safer, but over the long term inflation destroys cash’s purchasing power while equities build true wealth

The Most Important Things We Believe Equity Investors Should Focus on Today (6:18)

Why we believe selectivity is more important in a time of great market and economic transition and highs in both market concentration and valuations

Rigorous Research & Selectivity are Critical in Today’s Market (2:14)

Why we’re focused intently on identifying resilient companies with above average growth prospects - and not overpaying

The Attributes We Believe Investors Should Seek When Selecting an Investment Manager (2:25)

Look for the same characteristics in an investment manager that you'd look for in a company: a track record of execution, resilience, adaptability to change

Investment Themes in the Portfolio Today (1:53)

Why we see tailwinds and opportunities across Financials, Tech, Healthcare and Industrials

The Danger of Overly Aggressive Growth Assumptions (1:30)

Why investors often overpay for the inflated growth projections of today's high flyers - taking on risk in the areas they see as safe

Undervalued & Underappreciated – The Opportunity Today in Select Financials (4:05)

Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Uncovering Opportunities in the Tech Sector (3:35)

How we navigate the Technology sector, identifying companies with durable, growing earnings and avoiding the lofty valuations of "story stocks"

Having the Courage to Go Against the Crowd – A Closer Look at Our Investment in Meta (3:27)

Passive management often buys what's gone up and sells all the way down. Active managers can add real value by doing rigorous company research and bucking the consensus view

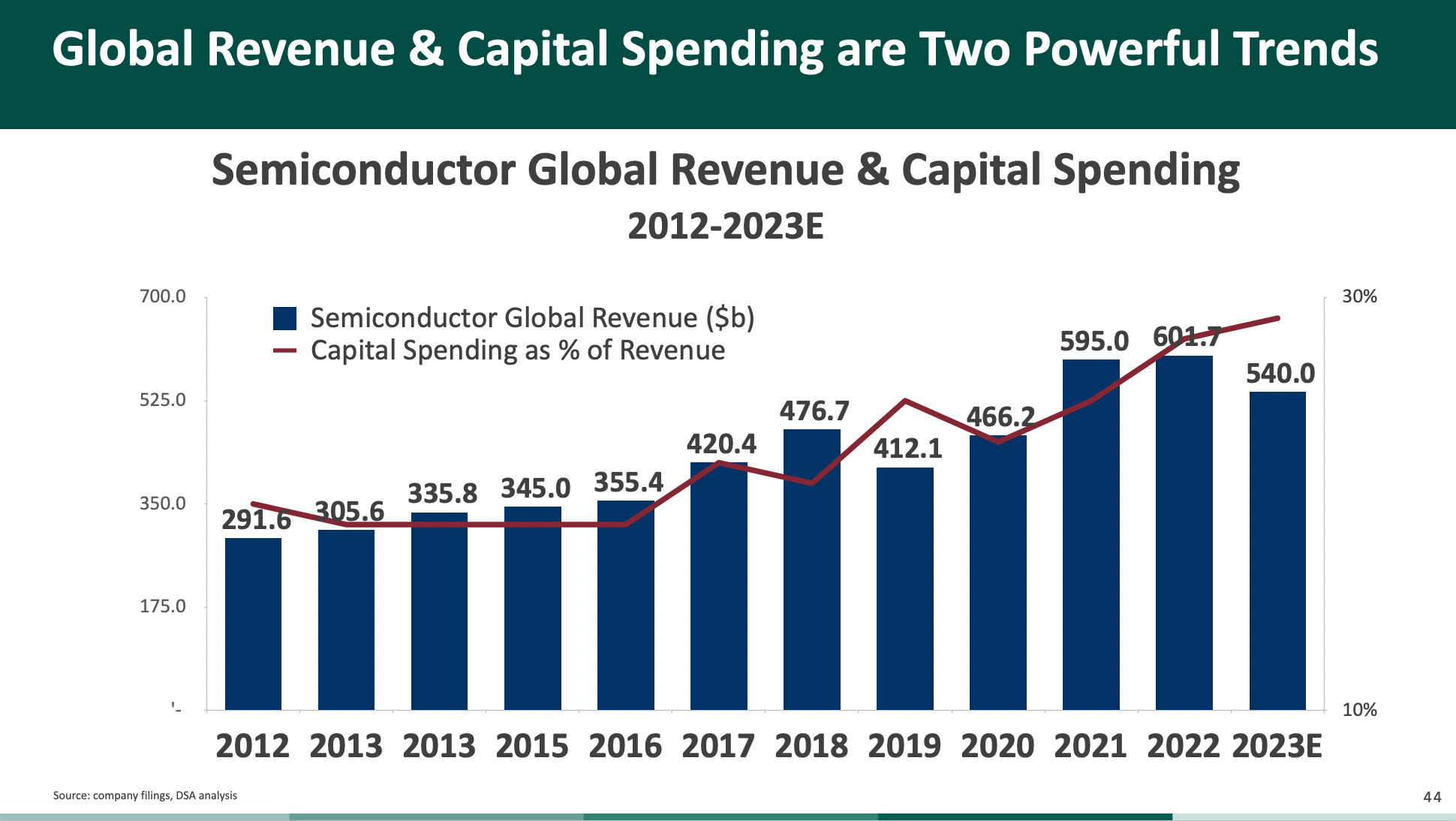

Opportunities in the “Picks & Shovels” of the Tech Sector (1:26)

Identifying the great, but out-of-the spotlight companies that support the current tech revolution

Separating Hype from Opportunity – Investment Implications of AI (4:44)

How we're thinking through transformational growth opportunities, along with the risk of the over-hyped companies and soon-to-be obsoleted business models

“Value Creators and Price Takers” - Investing in Healthcare Today (4:42)

Why we don't bet on blockbuster drug approvals - focusing instead on durable companies that are helping to manage costs across the healthcare system

“Hey ChatGPT – Finish this Building…Oh Wait!” Opportunities in the Industrial Sector (2:25)

Don't forget opportunities in the real physical world of commodities, agriculture and building products, far from today's over-hyped story stocks

Electrification, Teck Resources & the Supply / Demand Mismatch in Copper (3:25)

How companies like Teck Resources are helping to meet the challenges of building out electrical capacity in a transitioning world

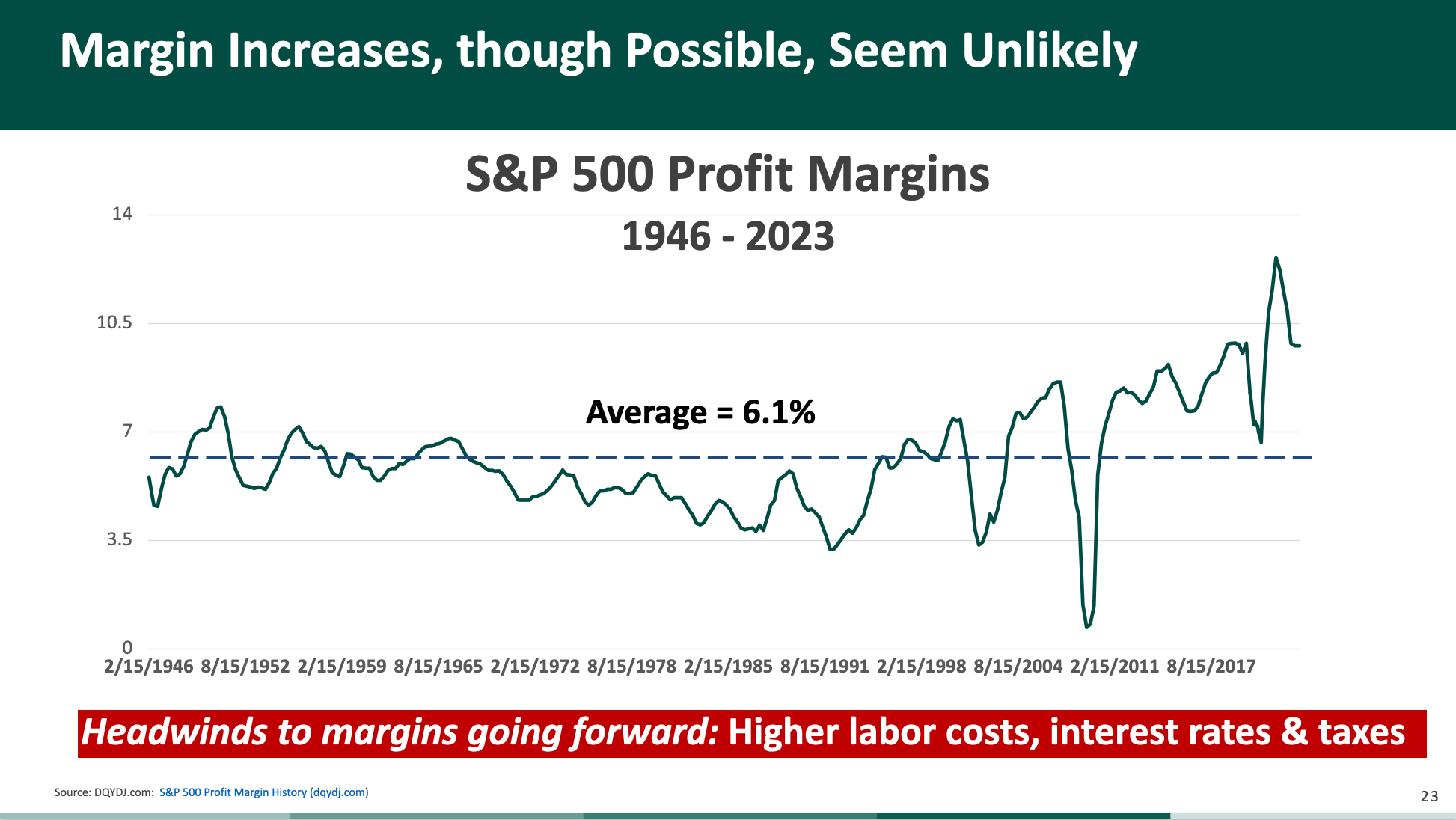

Predicting vs. Preparing, Navigating Sticky Inflation & High Valuations (4:19)

In a world of significant transformation, it's not about risk on / risk off. It's about aligning with durable, adaptable, growing businesses and not overpaying

Strategies to Mitigate the Investor Behavior Penalty (3:40)

The most common and damaging investor penalty comes from rushing in at euphoric high prices and panic selling at the lows. Here's a real alternative.

How Selected American Shares is Benefiting in this Transitioning Market

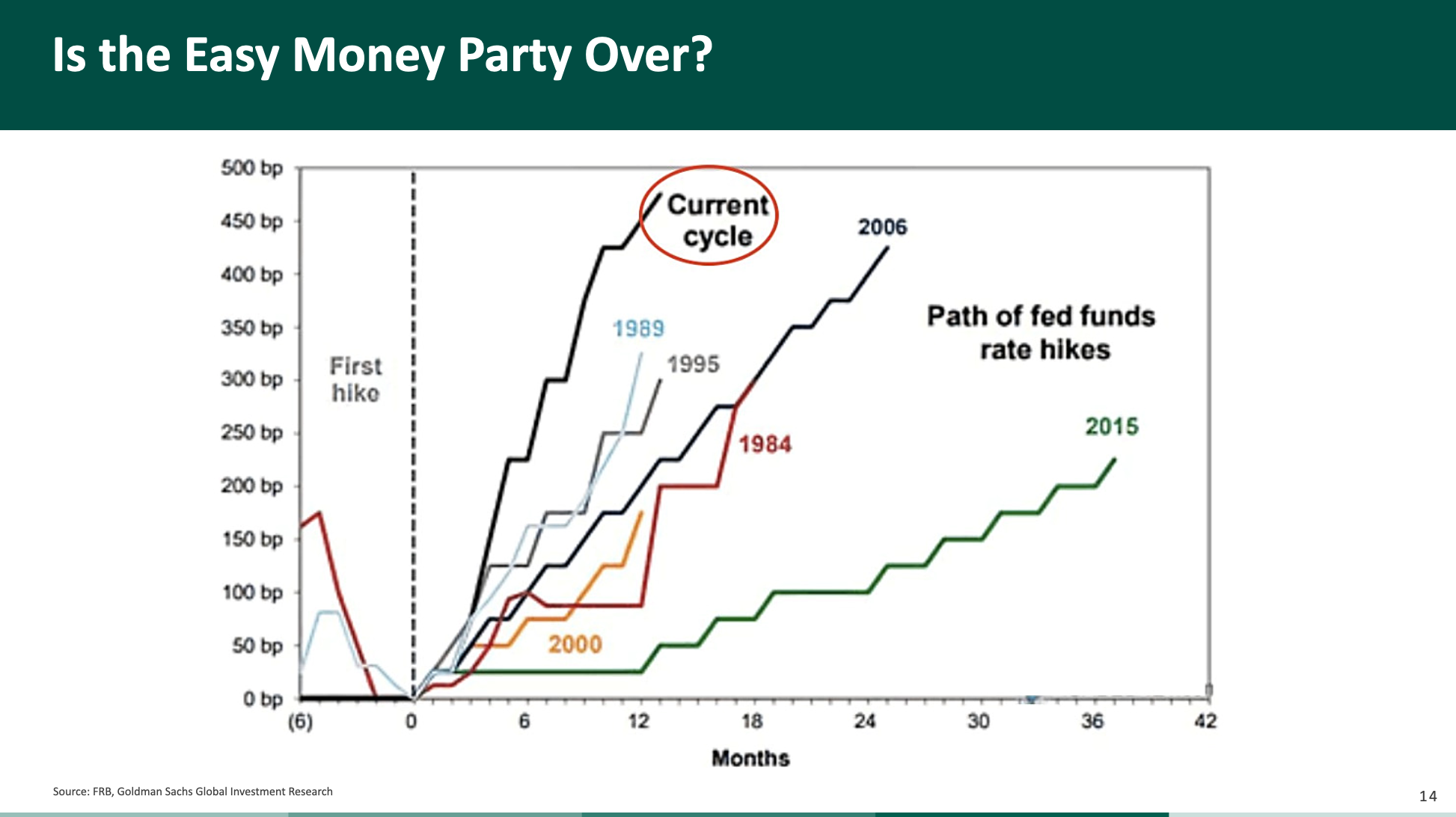

The end of the easy-money era, why fundamentals matter again and drivers of recent performance

The Return to Rationality

The bursting of the easy money bubble marks a huge transition for the markets

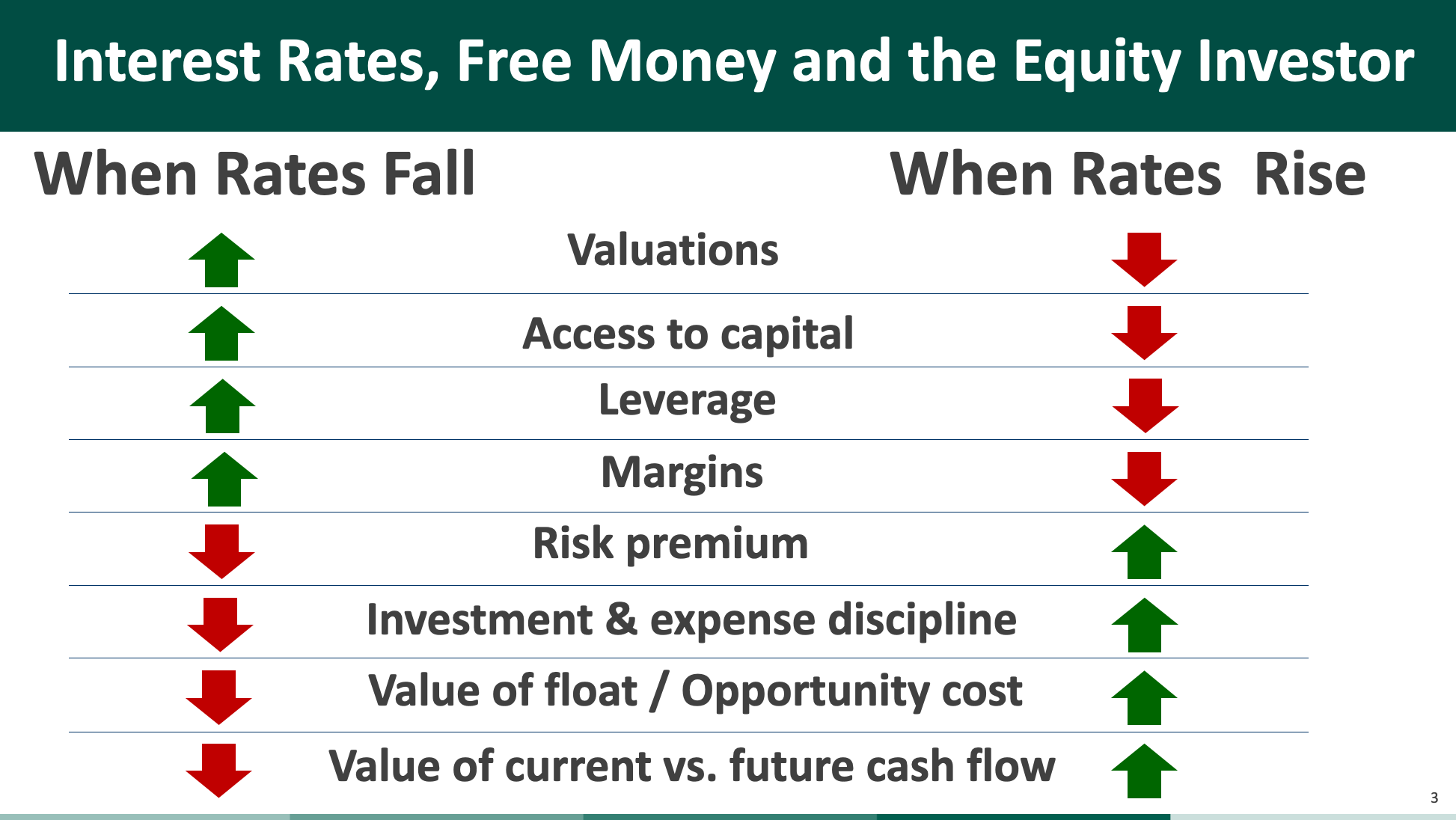

Investor Implications of Rising Rates

How the end of the free money era is ending the distortions of the past decade and returning rationality to the markets

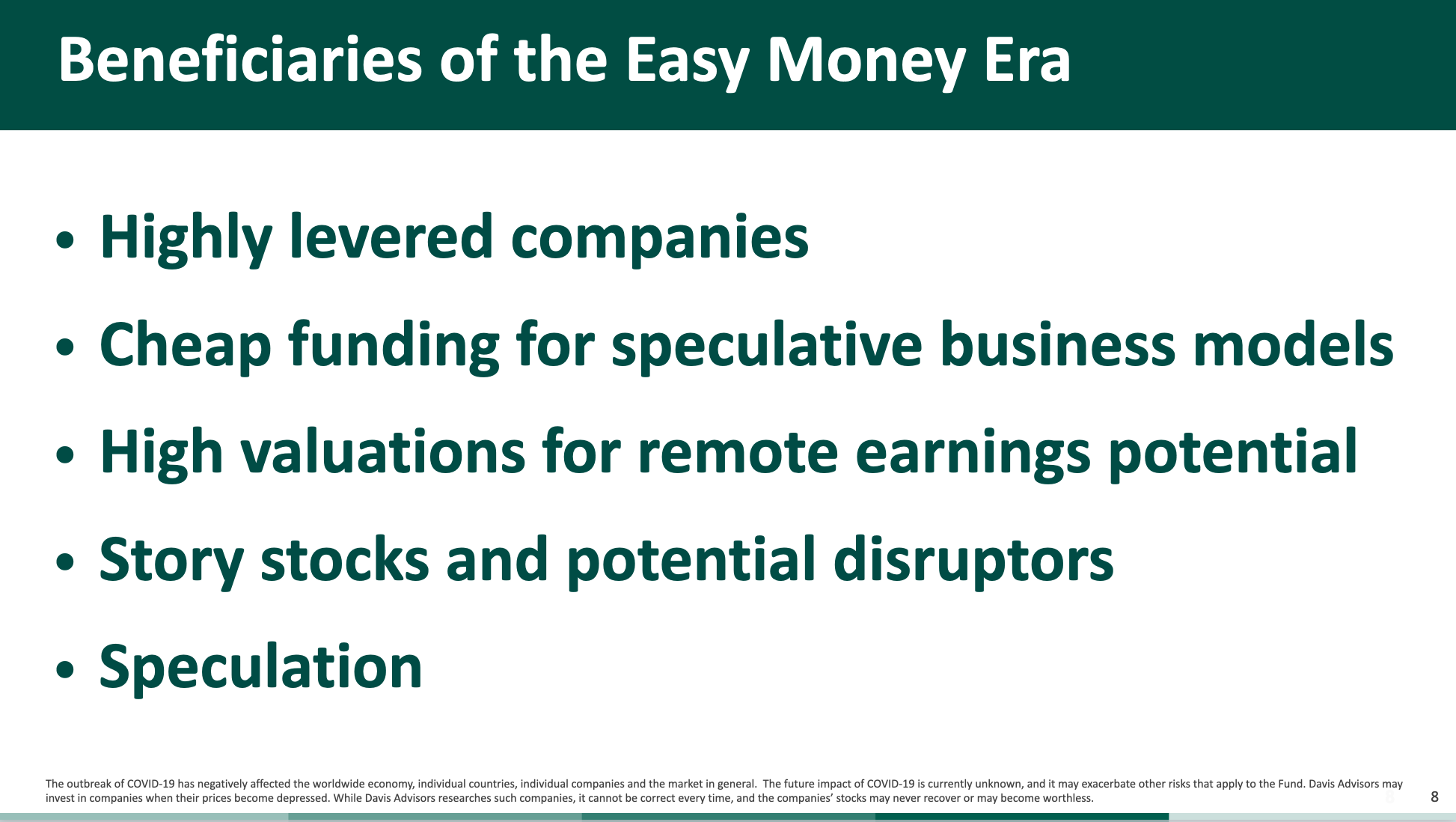

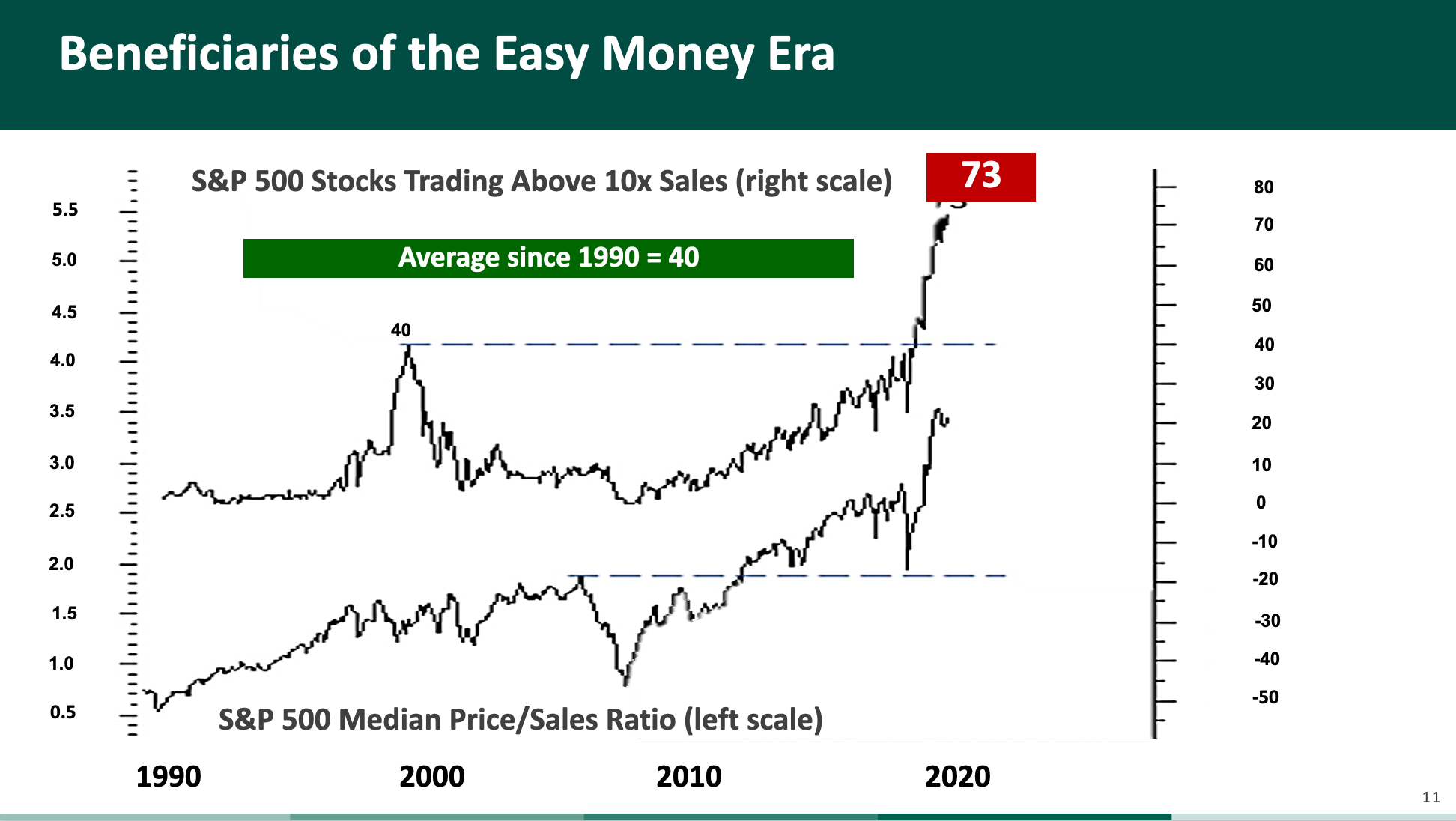

The Easy Money Era – Who Was Helped

The long period of low interest rate fueled a bubble, creating widespread market distortions and irrational valuations

Companies Who Rode the Easy Money Bubble

Examples of how the low interest bubble era fueled speculation and irrational valuations

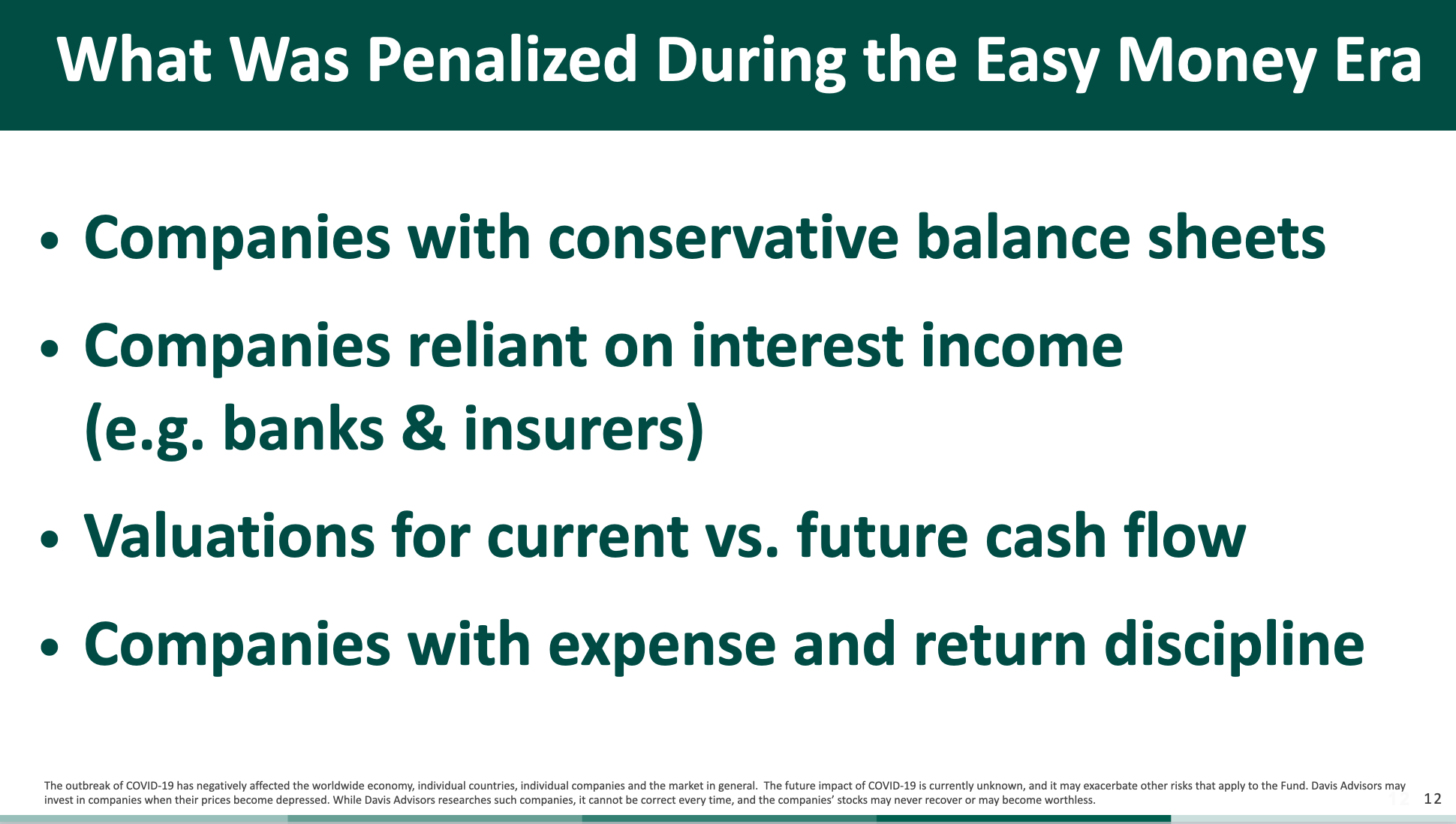

The Easy Money Era – Who Was Hurt

The long period of low interest rates punished companies who were succeeding by traditional measures

The Bursting of the Speculative Bubble

The speed of the current rate-hiking process and how it’s impacting companies who benefitted in the easy money era

What to Own and Avoid in Today’s Market

In our view, what types of companies should be avoided, and which stand to benefit from the end of the easy money era

Investment Themes We’re Focusing on Today

Tech, Semis, Financials and other themes we expect to drive returns

The Opportunity in Semi-Conductors

The huge, long-term tailwinds driving Semiconductor growth

Navigating Headwinds with Active Management

The ever-expanding margins and valuations of the past decade are unlikely to be sustained

Evolution of the Economy is Creating Unique Opportunities

Electrification is driving copper demand, and the “decarbonizing” of energy is driving biofuels

Finding Value Stocks in a Market Dominated by the Magnificent Seven

Investors have rushed to a narrow universe of companies, driving valuations higher and placing the stocks in danger if growth disappoints

Why We Believe Select Banks are Undervalued Today

Why we believe select banks are attractive, given their durability, long-term growth, competitive advantages, growing market share and attractive valuations.

How Investors Should Prepare for the End of the “Easy Money” Era

As rates normalize, certain business models are going to be severely challenged. What kind of companies do you want to own?

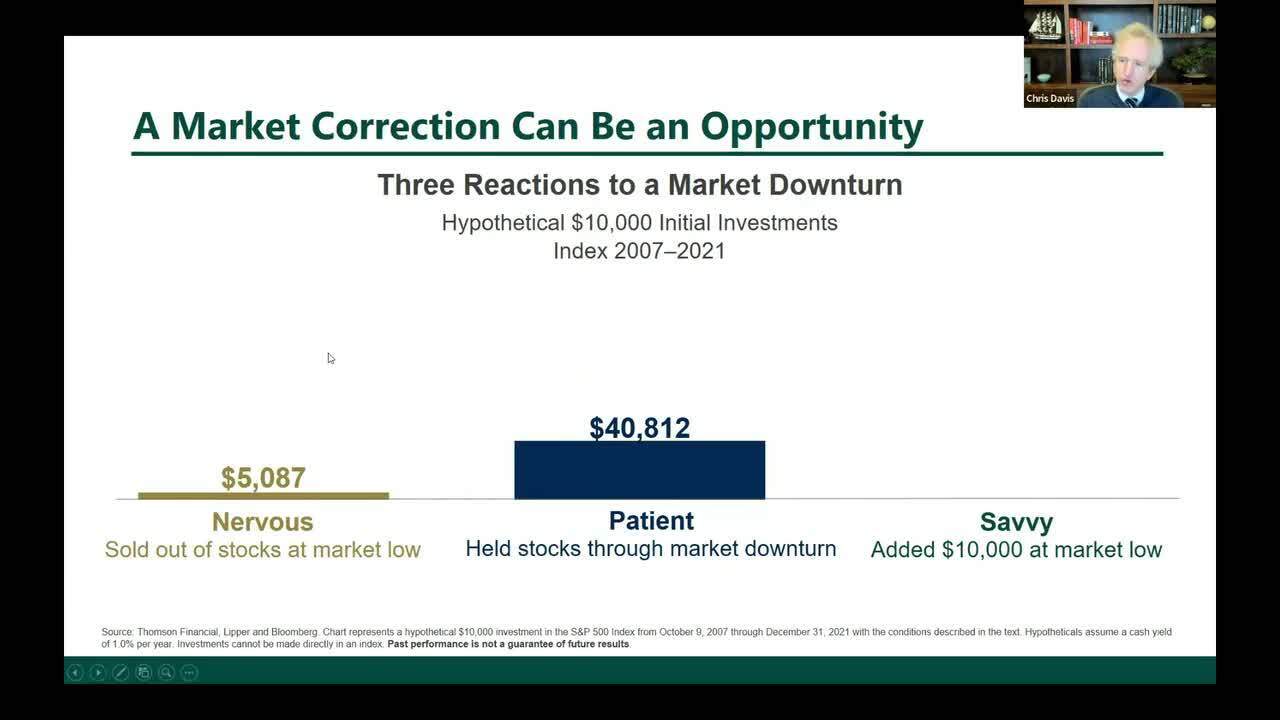

Volatility is the Price of Admission for Long-Term Returns

To benefit from the wealth-building potential of equities, investors need to understand that pullbacks and drama will be an inevitable part of the journey.

Equities Role During Periods of Inflation

How inflation quietly eats away at the purchasing power of consumers and how Equities – while volatile in the short term – can help investors build long-term wealth faster than inflation can degrade it

“Fragile Value” & “Speculative Growth” Areas to Avoid

Identifying vulnerable companies in both the Value and Growth camps – each dangerous in their own ways

Recession Potential and Impact on Portfolio Positioning

Predicting is futile. Buy businesses that have proven resilient through the inevitable storms. Investors are now being reminded of the critical importance of business durability.

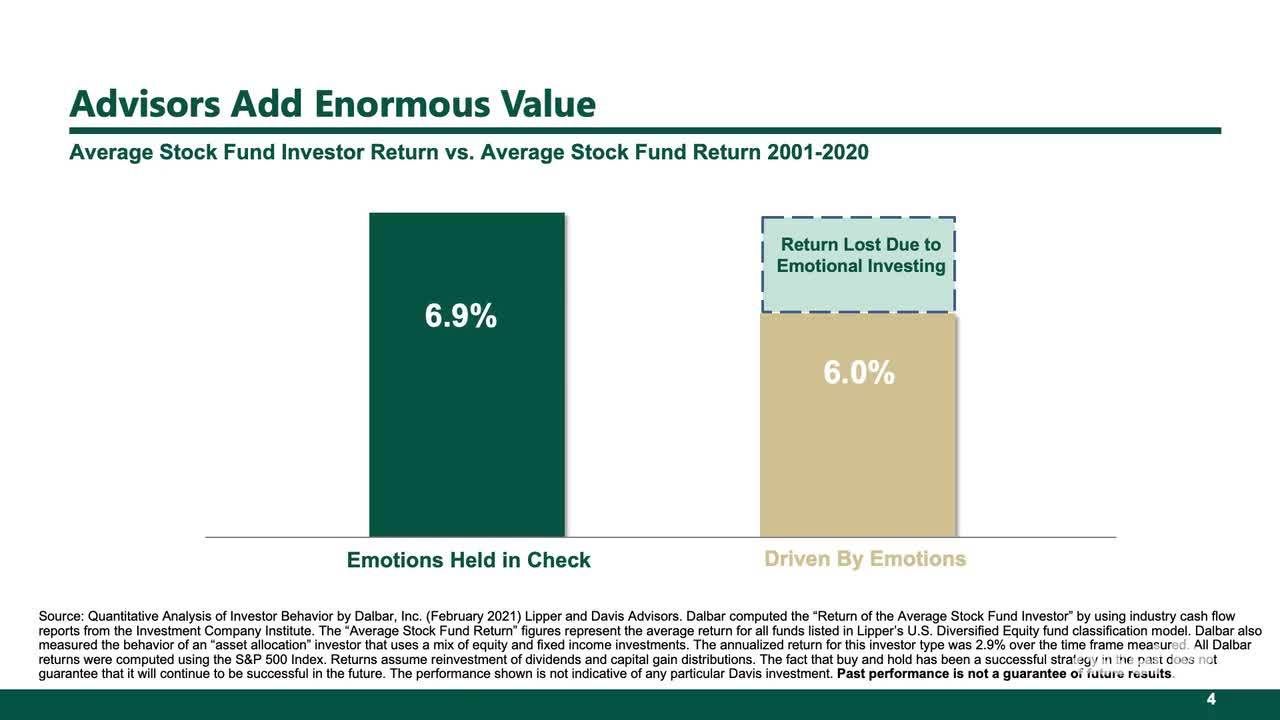

The Incredible Value Advisors Can Add During Volatile Markets

How the guidance of a financial advisor can help investors successfully build wealth as they navigate inevitable market volatility.

Why Successful Investors Keep Emotions in Check

How emotion can impact the ability of investors to successfully compound wealth and the importance of partnering with a financial advisor.

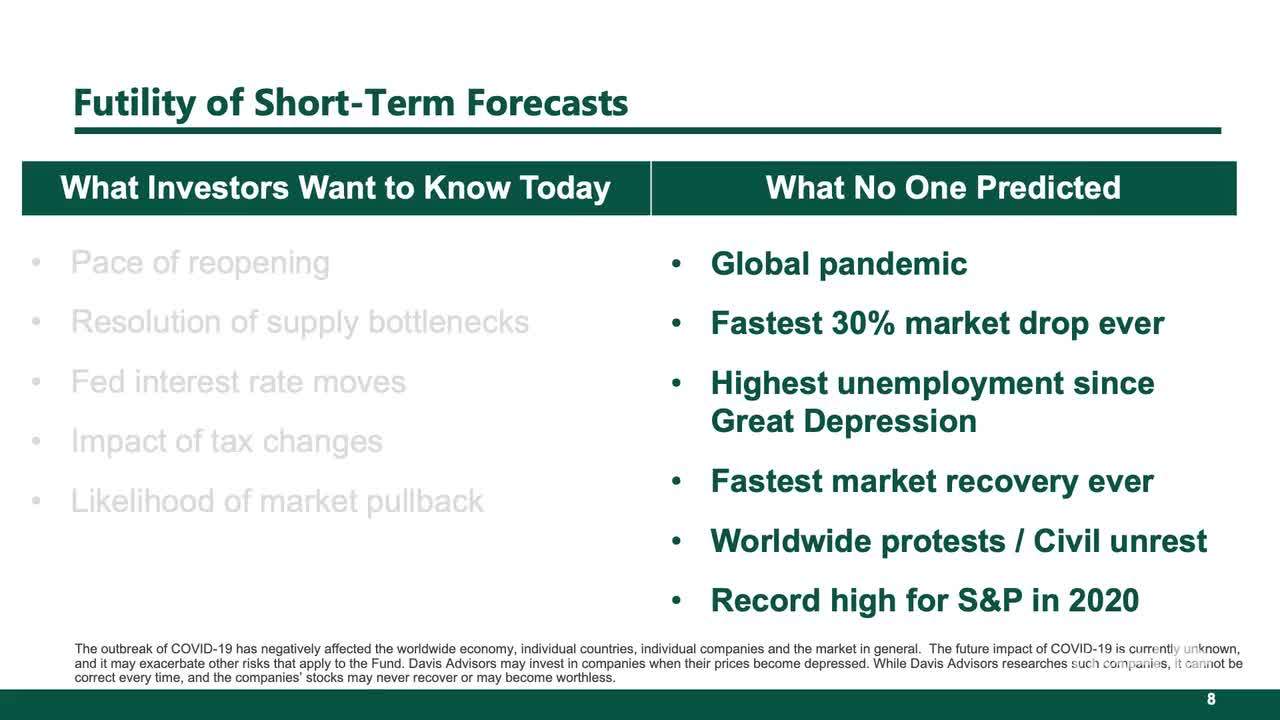

Why Investors Should Disregard Short-Term Forecasts

Market forecasters have a terrible record of predicting the future. Investors influenced by them may be sabotaging their returns.

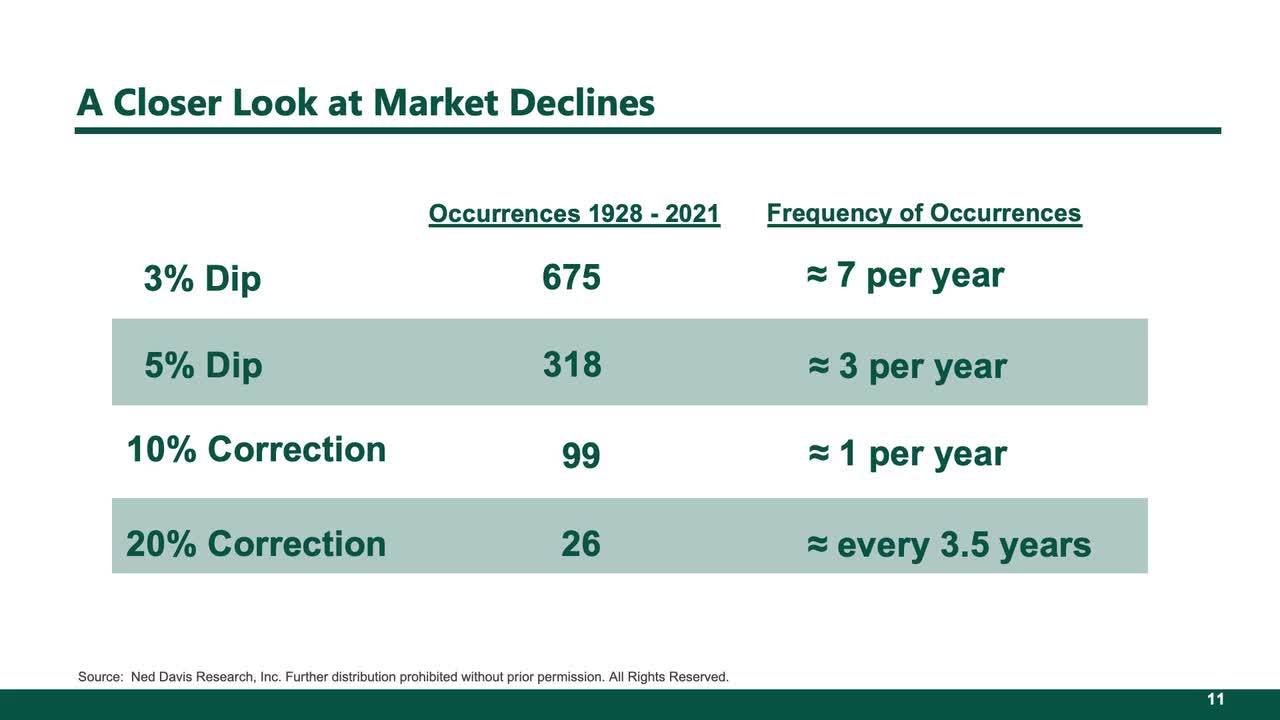

Recognize that Market Declines are Inevitable

10% market corrections happen once a year on average. Don’t allow these inevitable pullbacks to sway you from your investment plan.

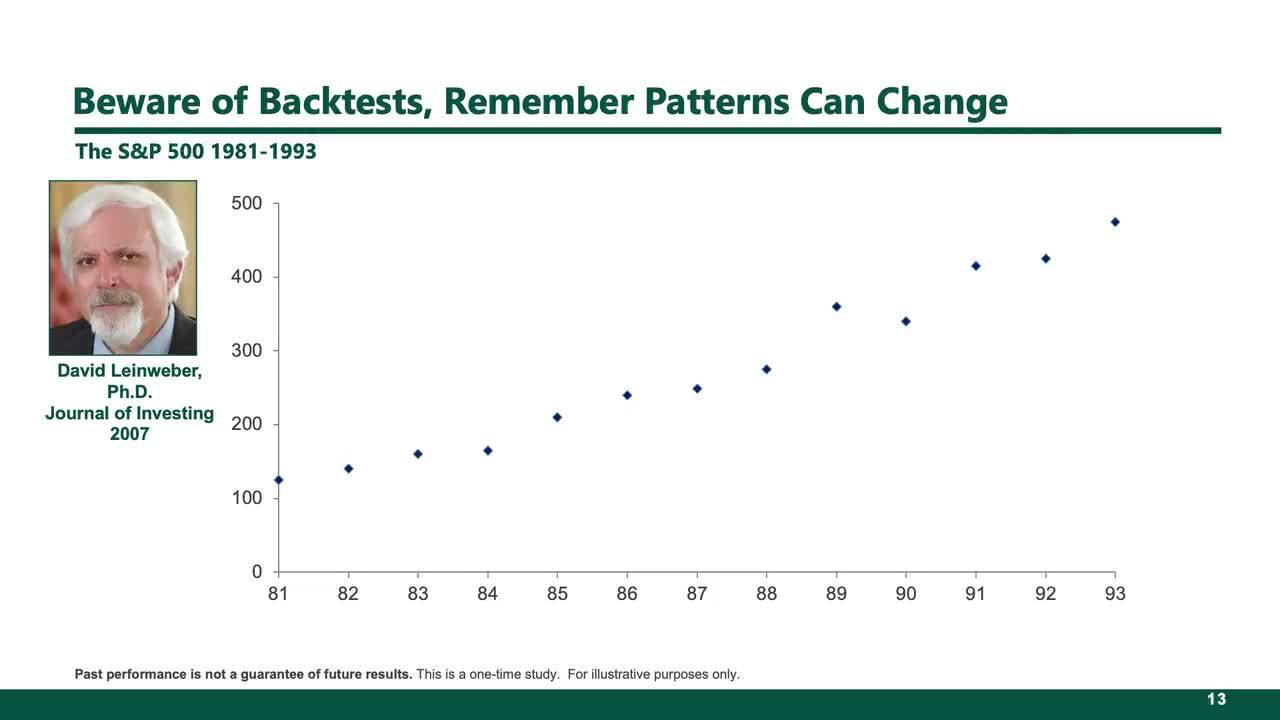

Correlation Does Not Equal Causation

The danger of investment products built on back testing. Markets continuously evolve and factors that seemed to have worked in the past may not work going forward.

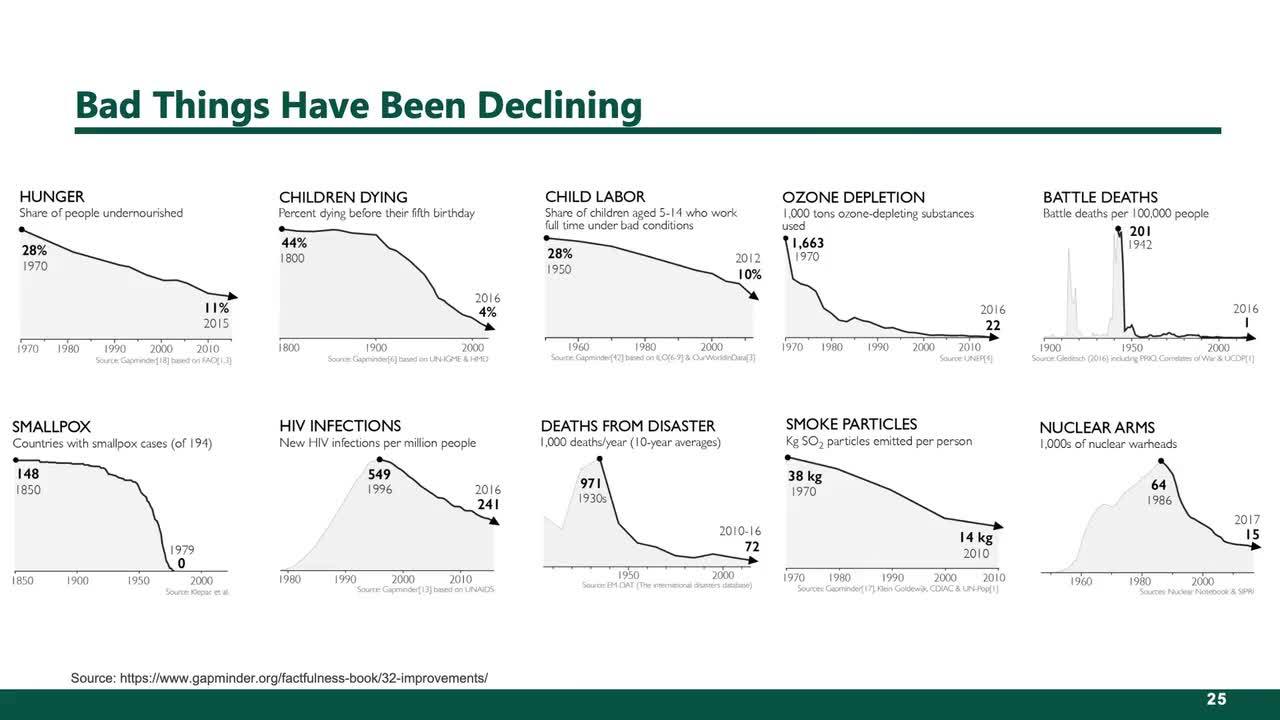

You Always Sound Smarter when You’re Bearish

The vast majority of factors across society and around the world have improved massively for decades. Betting against long term progress is a loser’s game.

How Inflation Impacts Portfolio Positioning

The types of companies that may continue to thrive if inflation increases.

Tuning out the Tweets

The most important lessons on successfully compounding wealth from our 50 years in the equity markets

The $1000 Hot Dog

Chris Davis tells Barron’s about the powerful lesson his grandfather taught him about thrift, financial independence and the miracle of compounding.

$2 Billion Invested Alongside Shareholders

Our exceptional co-investment ensures that we focus on generating attractive returns, managing risk and minimizing expenses.

Charlie Munger & the Fishing Lure

Chris Davis shares Berkshire Hathaway investing legend Charlie Munger's humorous wisdom on the futility of forecasts and predictions.

Where is the Market Headed from Here?

No one can consistently predict the markets over the short term, yet there are ways to invest with confidence to reach your long-term goals.

Wisdom from Buffett, Munger & Graham

The profound influence these investment icons have had on our firm and philosophy.

Investment Lessons from My Grandfather & Father

“You make most of your money in a bear market, you just don't realize it at the time”, and other key insights.

The “Mistake Wall”

How the mistakes hung on the wall of our research department help us to improve investment returns.